In today’s challenging economic landscape, achieving financial success can seem like an elusive goal for many Kenyans. The rising dollar has put a strain on our wallets, making it harder to make ends meet. However, there is hope. By paying attention to the small details of our finances, we can make a big difference in our financial well-being. In this article, I will share practical tips to help you survive and thrive in these tough economic times.

When it comes to financial management, the devil is in the details. Every shilling counts, and by paying attention to the small details, we can have a better understanding of our financial situation and make informed decisions.

1. Start by meticulously tracking your income and expenses. Keep a record of every transaction, no matter how small. This will give you a clear picture of where your money is going and help you identify areas where you can cut back or make adjustments. A simple spreadsheet or a budgeting app can be incredibly helpful in this regard.

2. Pay close attention to those sales in supermarkets. They are not always real sales. Recently I was shopping for the fam and was about to take a promo “3x700g” pack of spaghetti when I did the math and realized taking one 700g packet was still way cheaper than taking three. One is 199 KES. The 3-pack pricing is 639 KES. Do the math. 14 shillings more for each one of them! It made no sense to me. The guy that was unloading them laughed and told me I was right. The packs are not always cheaper. Pay attention.

3. Get on those shopping apps and cards they always ask you about. I especially love Carrefour’s because of all the great discounts and redemption of points. I paid for my last shopping with points garnered over a period of a few months. They amounted to about 7,000 KES. Kitambo I used to ignore the Chandarana guys when they asked me if I had their card. Not anymore. Especially after discovering that Chandarana can also be very expensive. I actually avoid it whenever I can.

4. Whenever you can, avoid buying small things at the kiosk next door. There is a markup attached to it. Buy things in bulk if you can. And I am not saying buy perishable stuff and wait for it to expire in the house, no. Buy what is realistically fit for your family.

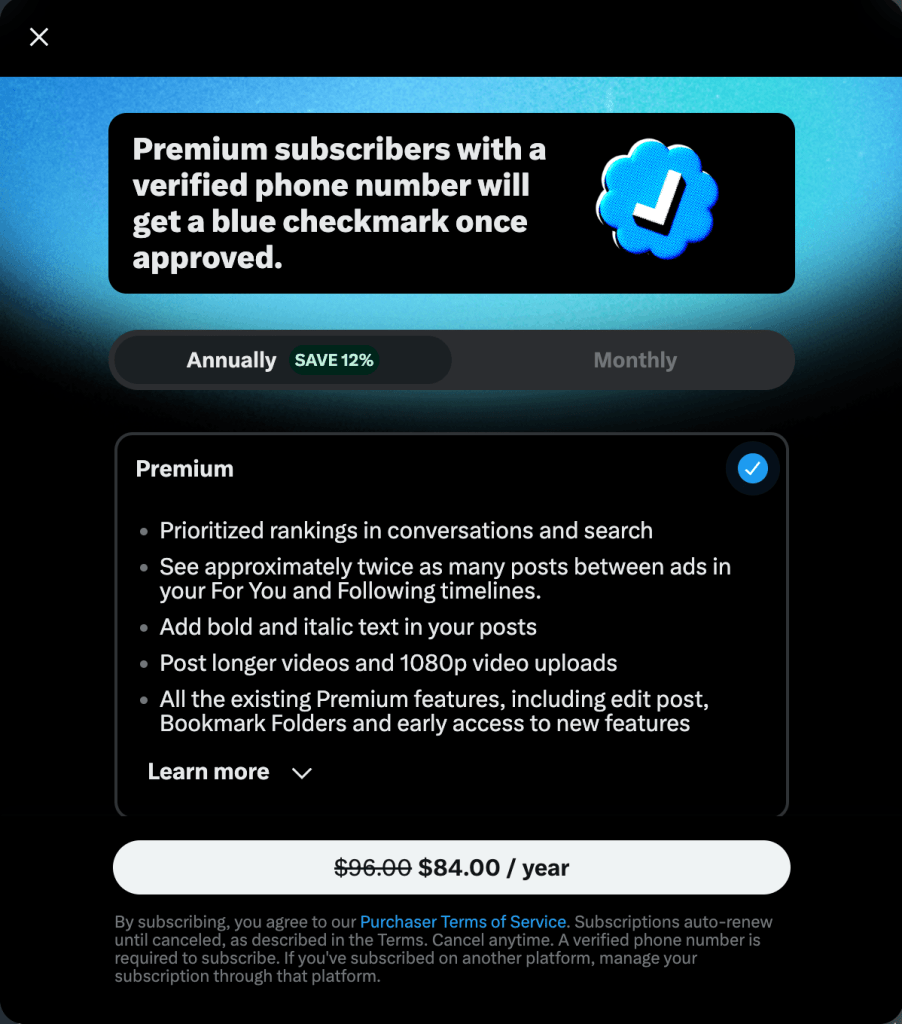

5. Review your subscriptions and memberships: We sign up for subscription services without realizing how quickly the costs can add up. Take the time to review all your subscriptions – whether it’s for streaming services or subscriptions. Consider cancelling those you no longer use or need. Currently, we are thinking of cancelling our Netflix subscription because the time to watch went out the window with our current schedules. Also, don’t fall for those online service subscriptions that make you think you need to buy a yearly subscription. I know someone who recently fell for that trick and spent a whole lot of unnecessary money on a service. You can always turn off that toggle and use the service for that one month or two you need it for.

6. Negotiate your bills: Don’t be afraid to negotiate with your service providers. Contact your internet provider, insurance company, and others to see if they can offer you a better rate. Sometimes, simply asking for a discount or researching alternative options can result in significant savings.

7. Save on transportation: Transportation expenses can quickly eat into your budget. Did somebody say fuel? I remember a time 3000 KES was enough to get a full tank on your average Toyota sedan. Today, 6000 KES is hardly enough. Consider using public transportation instead of driving alone. Additionally, compare fuel prices at different gas stations to find the most affordable option. If possible, walk to nearby destinations to save on fuel costs. It’s good for your health too!

8. Build an emergency fund: Having an emergency fund can provide you with peace of mind during uncertain times. Set aside a small portion of your income each month into a separate savings account. The MShwari Lock Savings account can be really good for this, especially with the interest they give you. However, if the specified amount of time you had set has not lapsed, you receive the money 48 hours after requesting the withdrawal. An emergency fund will come in handy when unexpected expenses arise, helping you avoid high-interest loans or other unnecessary debt.

By implementing these points, you can gain better control over your finances and navigate the challenging economic landscape more effectively. Remember, even small changes can make a significant impact on your financial well-being. Keep focusing on the details. Remember, it’s the small steps that lead to significant progress.

To learn more about surviving in these tough economic times and discover additional tips to help you thrive, subscribe to our newsletter for regular updates and exclusive content.